Hiring a Licensed public accountant (CPA) may be a greater alternative rather than doing all of your taxes by on your own, nevertheless it is determined by your tax circumstance and Choices. possessing a CPA do your taxes is often advisable In case you have a company or any kind of facet position, or if you’ve been contacted because of the IRS to get a tax-linked make any difference.

boosts in value of your home aren't income till you realize the raises via a sale or other taxable disposition.

your return from your property any time in the day or evening. indicator your return electronically employing a self-selected PIN to finish the process. there is absolutely no signature variety to post or Forms W-two to send out in.

To claim a common company credit history, you might very first have to have the kinds you might want to declare your existing 12 months small business credits.

When preparing a press release of income and expenditures (typically, your income tax return), you must make use of your books and records for a certain interval of time known as an accounting time period.

James O. claims, "I now experience confident in dealing with the affairs of my businesses and also to arrange for up coming calendar year tax submitting. I really advocate him !Thank you Joey"See a lot more

think about the complexity of the tax return and what level of expertise you’ll involve. right before entrusting somebody with the personal monetary and personal facts, do some research on their qualifications. The IRS includes a searchable database in which you can verify the history and credentials of your respective income tax preparation professional. upon getting selected an individual, ask about their service costs and ensure their availability. Then provide them with each of the documentation they call for, like W-2s, 1099s plus much more. normally question to review the paperwork before it is submitted, and never ever sign a blank tax return.

Don’t have a checking account? to locate a financial institution having an online account that’s best for your needs, Check out the FDIC Web-site. in the event you’re a veteran, locate possibilities Using the Veterans Gains Banking system (VBBP). You may as well ask your tax preparer for electronic payment solutions.

This element points out no matter if You should file an income tax return and whenever you file it. Furthermore, it describes the way you fork check here out the tax.

I hired Laurie soon after yrs of dealing with a considerable accounting organization. Her tax preparation/submitting support was effective, responsive, and cost effective. I remarkably propose her.

When self-making ready your taxes and filing electronically, you should sign and validate your electronic tax return. To confirm your id, use previous yr’s AGI or last 12 months’s self-decide on signature personal identification selection (PIN).

Report payments you receive from a lessee for canceling a lease inside your gross receipts from the yr obtained.

there are numerous factors it could be worth it to acquire a highly trained professional do your taxes as an alternative to self-filing. by way of example, it may also help decrease the potential for you making a mistake that could land you in issues Together with the IRS.

cost-free File Fillable kinds are electronic federal tax sorts, akin to a paper 1040 variety. You should know how to organize your personal tax return using variety Guidance and IRS publications if required. it offers a free of charge choice to taxpayers whose income (AGI) is larger than $seventy nine,000.

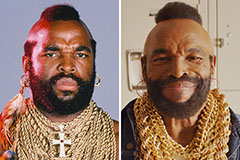

Mr. T Then & Now!

Mr. T Then & Now! Shaun Weiss Then & Now!

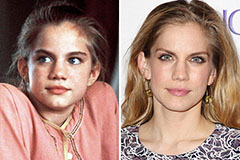

Shaun Weiss Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!